Discover Wyoming Credit Unions: Comprehensive Financial Providers Near You

Discover Wyoming Credit Unions: Comprehensive Financial Providers Near You

Blog Article

Transform Your Financial Future With Credit Rating Unions

Lending institution have actually been obtaining focus as trustworthy monetary organizations that can positively impact your financial future. Their unique framework and member-focused technique provide a variety of benefits that traditional financial institutions might not offer. By embracing the worths of neighborhood, partnership, and monetary empowerment, lending institution provide an interesting choice for people aiming to enhance their economic wellness. As we discover the different ways credit score unions can assist you achieve your monetary goals, you'll find how these establishments stick out in the financial landscape and why they may be the key to changing your future financial success - Wyoming Credit Unions.

Benefits of Signing Up With a Credit Rating Union

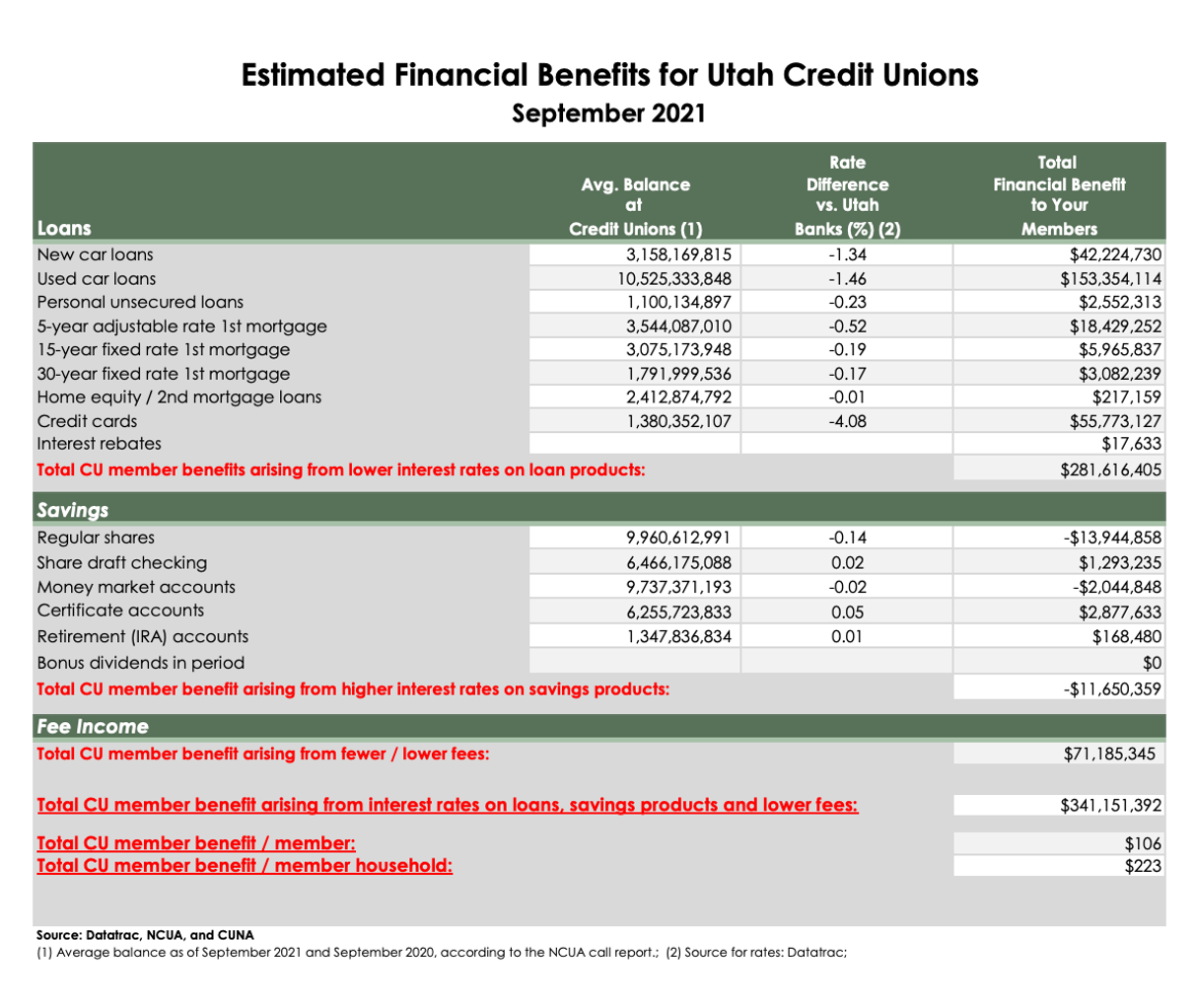

Debt unions are understood for having lower account maintenance fees, reduced overdraft charges, and frequently reduced rate of interest prices on car loans and credit history cards. Additionally, credit score unions are member-owned, not-for-profit financial establishments, which suggests they are concentrated on offering their participants instead than generating earnings for shareholders.

Additionally, lending institution have a tendency to supply affordable rates of interest on interest-bearing accounts and deposit slips. This can help participants expand their cost savings gradually more successfully than if they were making use of a conventional bank. Lots of credit scores unions additionally give access to monetary education resources, assisting participants boost their financial proficiency and make more educated decisions regarding their cash. On the whole, signing up with a credit union can be a smart move for people wanting to improve their economic wellness.

Cost Savings Opportunities for Participants

When thinking about economic institutions that prioritize member benefits and provide useful prices and solutions, credit rating unions attract attention as companies of significant cost savings chances for their participants. Credit history unions commonly offer greater passion prices on cost savings accounts contrasted to typical banks, permitting members to gain extra on their deposits. Additionally, several lending institution supply various savings items such as deposit slips (CDs) with affordable rates and terms, assisting participants expand their cost savings better.

An additional cost savings opportunity cooperative credit union supply is reduced charges. Cooperative credit union are recognized for billing fewer and reduced costs than banks, causing cost savings for their members. Whether it's reduced account upkeep costs, atm machine fees, or overdraft fees, cooperative credit union make every effort to keep costs very little, inevitably profiting their participants.

Additionally, credit unions often provide financial education and learning and counseling solutions to aid members boost their economic literacy and make better saving decisions. By offering these resources, credit history unions equip their participants to attain their savings objectives and protect their monetary futures - Wyoming Credit. On the whole, lending institution present a variety of financial savings chances that can dramatically benefit their participants' monetary wellness

Cooperative Credit Union Loans and Fees

Credit rating unions' competitive finance offerings and desirable rates of interest make them a preferable Full Report choice for members looking for economic assistance. Unlike standard financial institutions, cooperative credit union are not-for-profit companies had by their members, enabling them to provide reduced finance rates and charges. Credit scores unions give numerous sorts of finances, consisting of individual fundings, car finances, home loans, and charge card. Participants can benefit from flexible terms, customized service, and the possibility to develop a solid economic structure.

With reduced operating prices contrasted to banks, credit unions can pass on the savings to their members in the form of reduced interest prices on loans. In addition, credit score unions are recognized for their tailored technique to financing, taking into account the person's debt background and monetary circumstance to offer affordable prices tailored to their demands.

Structure Credit With Credit Unions

To develop a strong credit rating and boost financial standing, collaborating with credit report unions can be a helpful and strategic technique. Lending institution provide numerous products and solutions designed to assist members develop credit rating sensibly. One essential advantage of utilizing cooperative credit union for developing debt is their concentrate on tailored service and participant satisfaction.

Credit score unions generally supply credit-builder loans, secured debt cards, and monetary education and learning sources to aid participants in establishing or repairing their credit score profiles. These products are developed to be much more budget-friendly and obtainable contrasted to those supplied by traditional banks. By making timely payments on credit-builder car loans or protected bank card, individuals can demonstrate creditworthiness and improve their credit history scores in time.

Furthermore, cooperative credit union often take a more all natural strategy when analyzing debt applications, taking into consideration variables past simply credit report. This can be especially useful for individuals with limited credit report or previous financial obstacles. By partnering with a debt union and properly using their credit-building items, individuals can lay a solid foundation for a secure economic future.

Preparation for a Secure Financial Future

One more trick facet of preparing for a protected financial future is constructing an emergency situation fund. Setting aside three to 6 months' well explanation worth of living expenses in a readily obtainable account can offer a financial safety and security net in case of unexpected events like task loss or medical emergency situations.

In addition to conserving for emergencies, it is important to think of long-term economic goals such as retirement. Adding to pension like a 401(k) or IRA can aid you protect your economic future beyond your functioning years.

Conclusion

Additionally, credit rating unions Home Page are recognized for their tailored method to lending, taking right into account the individual's credit score background and financial situation to use competitive prices tailored to their needs.To develop a solid credit background and improve economic standing, working with credit unions can be a advantageous and tactical approach. Debt unions provide numerous products and solutions developed to aid members develop debt sensibly.Credit score unions normally offer credit-builder loans, protected credit cards, and monetary education resources to help participants in establishing or repairing their credit profiles.Furthermore, credit rating unions commonly take an even more holistic technique when analyzing credit scores applications, thinking about variables beyond simply credit rating scores.

Report this page